Guest

Guest

Sep 29, 2025

10:10 AM

|

Elevate your talent attraction and retention with free employee benefits. Uncover a platform that effortlessly entices, engages, and retains your valuable staff Novated Leasing Calculator.

Novated leasing is an innovative car financing option that allows employees to save money on their car purchase and potentially enjoying significant tax savings. Let’s explore everything you need to know about novated leasing for employees, including how it works, what happens at the end of a novated lease, the benefits, and more.

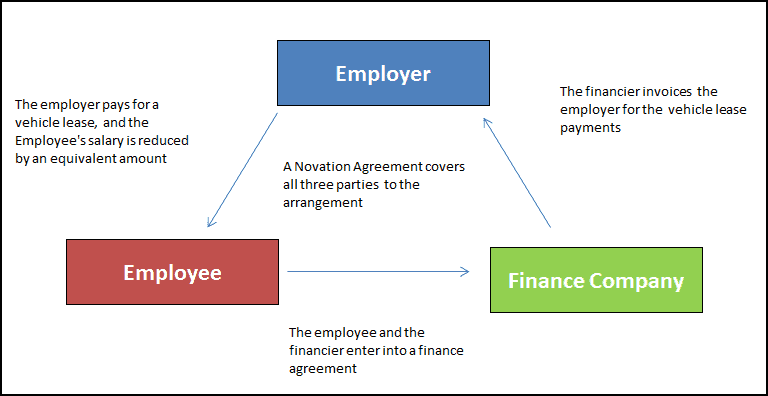

Cars are one of our biggest household expenses, yet many of us haven’t been exposed to the huge savings advantages that a novated lease can offer. It’s one of the cheapest ways to own and run your car. A novated lease is an arrangement between an employee, their employer, and a financier for a period of time, between one to five years. With a Flare novated lease, you can get the car you want now with no large upfront cost, and bundle up your vehicle finance and running costs like fuel and maintenance into convenient monthly payments. By doing this, you could make significant savings on the purchase price, your income tax, and GST too.

Novated leasing is a workplace benefit in which all the costs for running a car, as well as the vehicle purchase price, are taken directly out of your salary, through a combination of pre and post tax deductions by your employer.

You have a couple of options if you want to leave your current company. If your new employer offers novated leasing, then you should be able to transfer your novated lease over via your new employer’s salary packaging provider. Alternatively, if your new employer does not offer novated leasing, you can pay your finance directly to the financier; however, this becom

|